Capital Medica Ventures (CMV) tackles social challenges, mainly in healthcare and regional issues, by supporting and empowering entrepreneurs as a trusted partner.

-

Final Outcome

Beneficiaries162

million -

Employment by

Impact Startups737

-

Average Annual Business

Growth Rate

of Portfolio Companies151

percent -

Social Issue Solvers

19

-

Responsible Exits

3

We contribute to solving social issues mainly in the healthcare field and by working as a companion for entrepreneurs.

We contribute to solving social issues mainly in the healthcare field and by working as a companion for entrepreneurs.

Vision2030

Through venture capital activities utilizing the IMM method, we aim to generate high economic and social performance while producing 100 practitioners dedicated to solving social challenges.

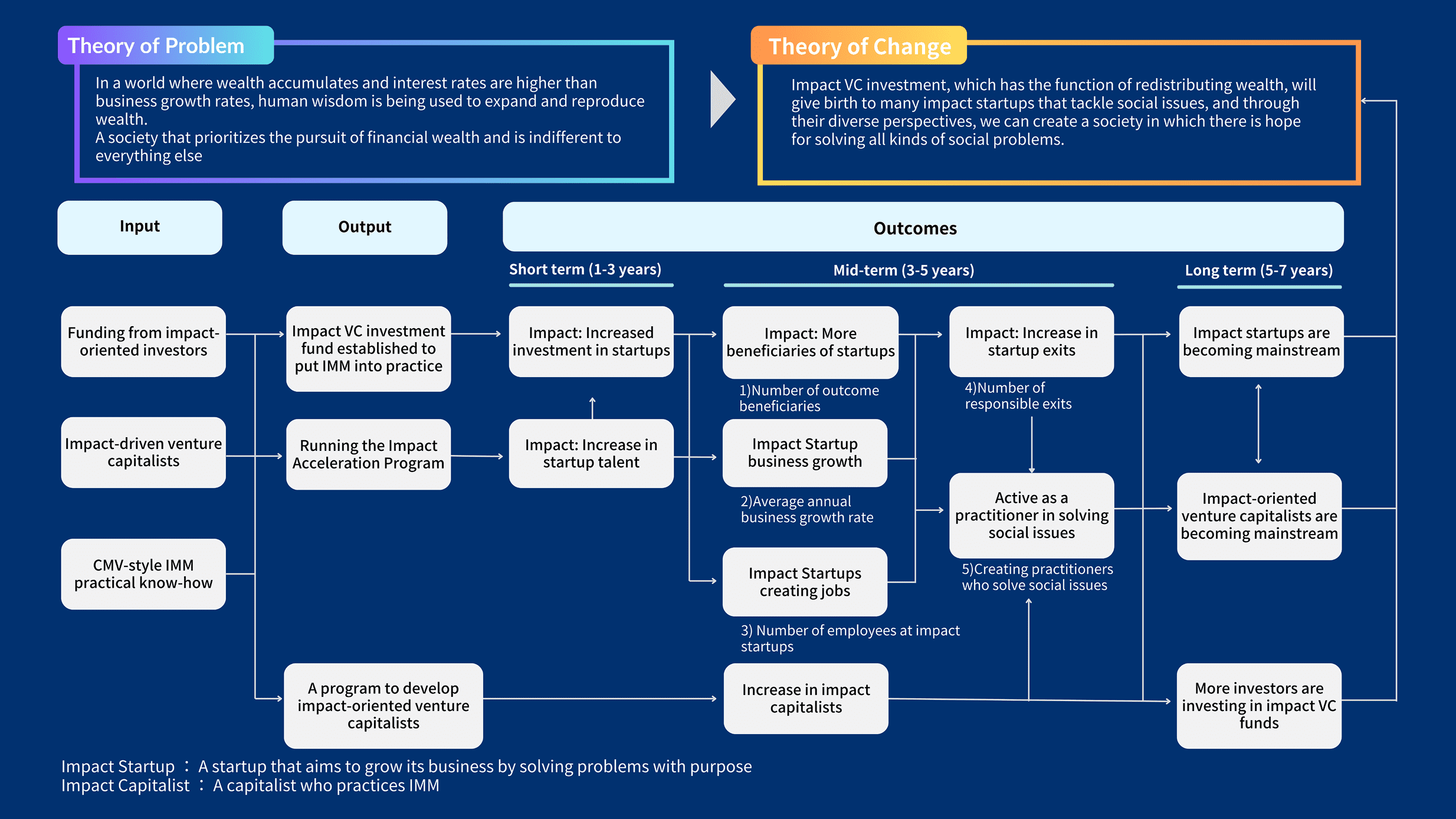

Theory of Change(ToC)

Theory of Change (ToC)

At CMV, our ultimate goal is to create a society where impact-driven startups tackling social challenges flourish, inspiring hope for solutions to a wide range of societal issues through their diverse perspectives. To achieve this, we aim to serve as a catalyst for wealth circulation and believe it is essential to cultivate impact-oriented venture capitalists who excel as partners supporting entrepreneurs committed to building a better society.

Portfolio

Implementation of Impact Measurement and Management(IMM)

Implementation of Impact Measurement and Management(IMM)

At CMV, impact investment means practicing Impact Measurement and Management (IMM). CMV provides hands-on support to startups that pursue essential customer value by leveraging the IMM implementation process. This involves process management to achieve the business goals of portfolio companies, including:

1.Assessing the current situation

2.Setting goals

3.Identifying gaps between the current state and goals

4.Planning the path to achieve the goals

5.Implementation

6.Revising the plan

7.Re-implementation

These steps are supported through the creation of logic models and other tools.

CMV's IMM framework is structured based on the international Operating Principles for Impact Management, to which CMV is a signatory. Through this approach, CMV enhances enterprise value and connects it to responsible exits, such as impact IPOs and Exit to Community models, optimizing investment returns.

Process from Investment Evaluation to Exit through IMM Implementation

Process from Investment Evaluation to Exit through IMM Implementation

STEP

Purpose

Activities

-

01

Sourcing

- Identify startups aiming for long-term growth

- Visualize challenges through workshops focused on understanding the structure of the issues.

- Operate programs for nurturing impact entrepreneurs.

- Distribute news and develop a database of potential investment candidates.

- Host study sessions and manage a community for impact capitalists.

-

02

Due Diligence

- Assess commitment to IMM practices and evaluate risks of investment candidates.

- Validate impact hypotheses through the creation of Theory of Change (ToC) and logic models.

- Evaluate the entrepreneurial learning and growth mindset.

- Assess impact risks using a customized framework based on the Five Dimensions of Impact and 9 Risk Framework.

- Review and support the creation of ToC and logic models for investment candidates.

-

03

Investment Execution

- Ensure exit feasibility, target returns, and alignment with desired social impact.

- Structure investment agreements according to identified risks.

- Define exit models (target multiples) and determine support strategies.

- Develop investment agreement frameworks.

- Conduct governance checks for conflicts of interest and other risks.

-

04

Hands-On Support

- Support business growth to achieve the entrepreneur's ToC.

- Provide assistance with current state assessments and support entrepreneurs' reflections.

- Deliver hands-on business support and ongoing monitoring.

- Set and track KPIs related to business benefits and customer outcomes, such as NPS.

- Facilitate strategic reviews through impact report creation.

-

05

Responsible Exit

- Achieve exits via impact IPOs, M&A, or Exit to Community strategies.

- Ensure alignment with target investment returns.

- Conduct evaluations for impact-focused exits.

-

STEP 01

Sourcing

Purpose

Purpose- Identify startups aiming for long-term growth

Activities- Visualize challenges through workshops focused on understanding the structure of the issues

- Operate programs for nurturing impact entrepreneurs.

- Distribute news and develop a database of potential investment candidates.

- Host study sessions and manage a community for impact capitalists.

-

STEP 02

Due Diligence

Purpose

Purpose- Assess commitment to IMM practices and evaluate risks of investment candidates.

- Validate impact hypotheses through the creation of Theory of Change (ToC) and logic models.

Activities- Evaluate the entrepreneurial learning and growth mindset.

- Assess impact risks using a customized framework based on the Five Dimensions of Impact and 9 Risk Framework.

- Review and support the creation of ToC and logic models for investment candidates.

-

STEP 03

Investment Execution

Purpose

Purpose- Ensure exit feasibility, target returns, and alignment with desired social impact.

- Structure investment agreements according to identified risks.

Activities- Define exit models (target multiples) and determine support strategies.

- Develop investment agreement frameworks.

- Conduct governance checks for conflicts of interest and other risks.

-

STEP 04

Hands-On Support

Purpose

Purpose- Support business growth to achieve the entrepreneur's ToC.

Activities- Provide assistance with current state assessments and support entrepreneurs' reflections.

- Deliver hands-on business support and ongoing monitoring.

- Set and track KPIs related to business benefits and customer outcomes, such as NPS.

- Facilitate strategic reviews through impact report creation.

-

STEP 05

Responsible Exit

Purpose

Purpose- Achieve exits via impact IPOs, M&A, or Exit to Community strategies.

Activities- Ensure alignment with target investment returns.

- Conduct evaluations for impact-focused exits.

Target assets under management

Target assets under management

A regional impact fund dedicated to addressing social challenges in Nara Prefecture and surrounding areas (the Yamato region). Approved as part of a dormant deposit utilization project, co-managed with local financial institutions, Nanto Bank and Nanto Capital Partners.

Investment Focus:

1.Health Capital: Initiatives in the healthcare sector.

2.Natural Capital: Agriculture, forestry, and other nature-based industries.

3.Cultural Capital: Education, cultural heritage, tourism, and sports-related activities.

Initiated under Tokyo Metropolitan Government policies, with CMV, a proven impact VC investor, selected as

the General Partner (GP). Co-managed with Monex Ventures, part of the Monex Group.

A regional impact fund dedicated to addressing social challenges in Nara Prefecture and surrounding areas (the Yamato region). Approved as part of a dormant deposit utilization project, co-managed with local financial institutions, Nanto Bank and Nanto Capital Partners.

Investment Focus:

1.Health Capital: Initiatives in the healthcare sector.

2.Natural Capital: Agriculture, forestry, and other nature-based industries.

3.Cultural Capital: Education, cultural heritage, tourism, and sports-related activities.

Initiated under Tokyo Metropolitan Government policies, with CMV, a proven impact VC investor, selected as

the General Partner (GP). Co-managed with Monex Ventures, part of the Monex Group.

OPIM Disclosure Statement

OPIM Disclosure Statement

CMV conducted an impact verification with BlueMark, a U.S.-based firm, to ensure alignment between the international Operating Principles for Impact Management (OPIM) and its own impact investment management framework. The verification resulted in a favorable evaluation of CMV's adherence to these principles.